There are many ways a Willmaker can equalise the benefits for their children under their Will.

This situation often arises where one or more of the adult children have received payments of money or property from their parents during their lifetime, to the exclusion of their other children. The parents want to ensure that on their death, all children receive an equal share of their estate.

- Hotchpot

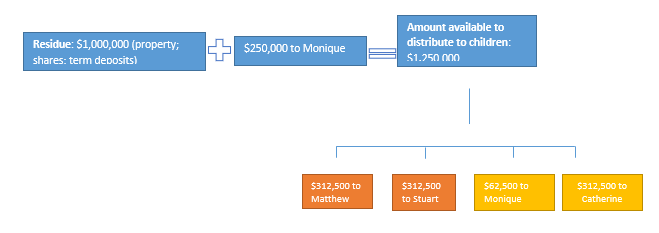

One option is to insert a ‘hotchpot’ clause under the parents’ Will. The effect of this is that advancements received from parents are taken as part satisfaction of a respective child’s share in the estate. This ensures that all of the children receive an equal share in the estate. Below is a simple example:

Simon and Lisa are married and have three children: Matthew, Stuart, Monique and Catherine. Simon and Lisa pay Monique $250,000 to assist with purchasing her first home. They want this money to be taken into ‘hotchpot’ when the survivor of them passes, so that each child receives an equal share of the residue of their estate.

Monique’s share is reduced by $250,000.

This approach is not perfect. If there is no record of the payment to Monique, it may give rise to a dispute during the estate administration, which can result in litigation. One approach to mitigate the risk of this happening is to have Simon, Lisa and Monique sign a Deed of Loan to record the advance of $250,000.

It needs to be clear within the terms of the Will, whether the unpaid amount of the advancement is to be repaid on the death of the parent, or is otherwise forgiven and forms part of the estate for the purposes of equalising the benefits between the children.

The equalisation provision best applies to distributions of cash, rather than distributions of assets, such as real estate or shares. If a beneficiary receives a transfer of real estate, and later disposes of the asset, then CGT may be applicable. Depending on their respective assessable income, the amount of tax payable will vary between the beneficiaries. This, in theory, reduces the value of the gift.

- Specific Gifts

Another option is for the parents to make specific gifts to the other children, equivalent to the value of the advancement. The gifts are in addition to the child’s share of the residue of the estate. The effect is that those children who did not benefit during the lifetime of their parents, will receive more from the estate.

Using the example above, ultimately, Matthew, Stuart and Catherine would each $250,000 in addition to their share of the residue of the estate.

The Willmaker will need to consider whether inflation is to be considered with respect to the value of the specific gifts.

At Perspective Law, we would be pleased to assist you with all your estate planning needs. Please contact our office on 07 3839 7555 for all your queries, or alternatively you can email Elizabeth Ulrick at elizabeth.ulrick@perspectivelaw.com, or any other member of our estate planning team today.